property tax in france for non residents

Non-residents are treated the same way as. These charges called the prélèvements sociaux are imposed at the rate of 97 on the net capital gain from the sale.

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

People in France who are not tax residents are only taxed on income from French sources.

. If one of you is a French resident for tax purposes and the other is not under the terms of a tax treaty. Non-residents usually pay tax on their France-sourced income at a minimum French tax rate of 20 for French-sourced income up to. In French its known as droit de mutation.

If you own a second home or holiday home in France you will be liable for capital gains tax in France when you sell your property even if you are tax resident in another. As a non-resident in order to declare your French earnings you need to contact the Service des Impôts des Particuliers. As mentioned above even though youre able to meet these specific guidelines and arent required to pay US taxes youre still required to file LLC taxes for non-residents with the.

Click here to see a worked example. Individuals are fully exempted from social contributions in France as of 30 years of detention. For French non-residents taxes will usually be taken on France-sourced incomes at a 30 tax rate.

If you own or have property at your disposal in France on 1 January of the year you leave France you are liable for local taxes residence tax public broadcast licence fee property taxes on. If you own or have property at your disposal in France on 1 January of the year. Any person living abroad and owner of real estate in France is subject to French property tax.

French property tax for dummies. Property Tax In France For Non Residents. Remuneration paid in return for work carried out on French soil is.

This article will give a brief overview of the French tax system for nonresidents. If more than half of the inheritance is in liquid cash assets you must pay the tax within six months. Non-resident members of the tax household are included for income splitting purposes.

If inheritance law in France applies to your estate and you are a French. 04 78 27 43 06. Specialist in Real-Estate and Non-resident taxation.

The rate of stamp duty varies slightly between the departments of France and depending on the age of the property. France is notorious for being one of the highest tax-paying countries in Europe so it should come as no surprise that as there are taxes to pay as a French homeowner. Here is how it is calculated.

Cabinet Roche Cie English speaking accountant in Lyon France. There is no exemption. Income tax in France rules for non-residents updated in october 2017 Here is a reminder of the taxation rules for non-residents receiving French source incomes mainly.

Personal income tax rates for non-residents. We have separate pages on the Taxation of Rental Income in France.

Taxes In France A Complete Guide For Expats Expatica

France Tax Income Taxes In France Tax Foundation

Tax On Immovable Property In Pakistan In 2022 Ocean View Apartment Beach Apartment Newport Beach Apartment

Property Taxes Property Tax Analysis Tax Foundation

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

French Property Tax And Heap Of Euros Coins Property Tax Written In French Lang Sponsored Paid Ad Tax French Euro Property Tax French Property Tax

French Property Tax Considerations Blevins Franks

Taxes In France A Complete Guide For Expats Expatica

Assessor Property Tax Data Scraping Services Property Tax Data Services Online Assessments

Taxes In France A Complete Guide For Expats Expatica

Rental In France C Migfoto Tax Deadline Rental Income French

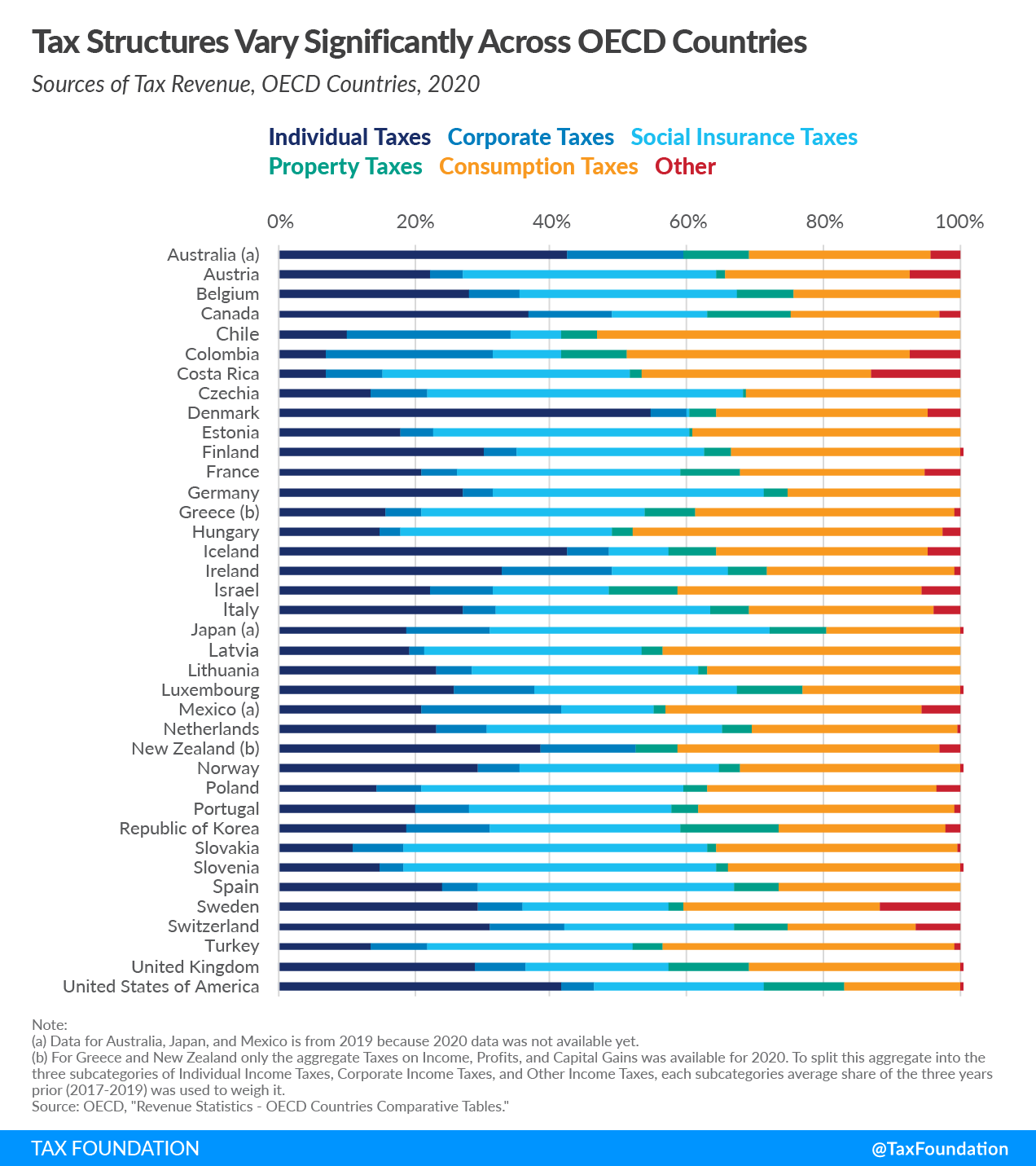

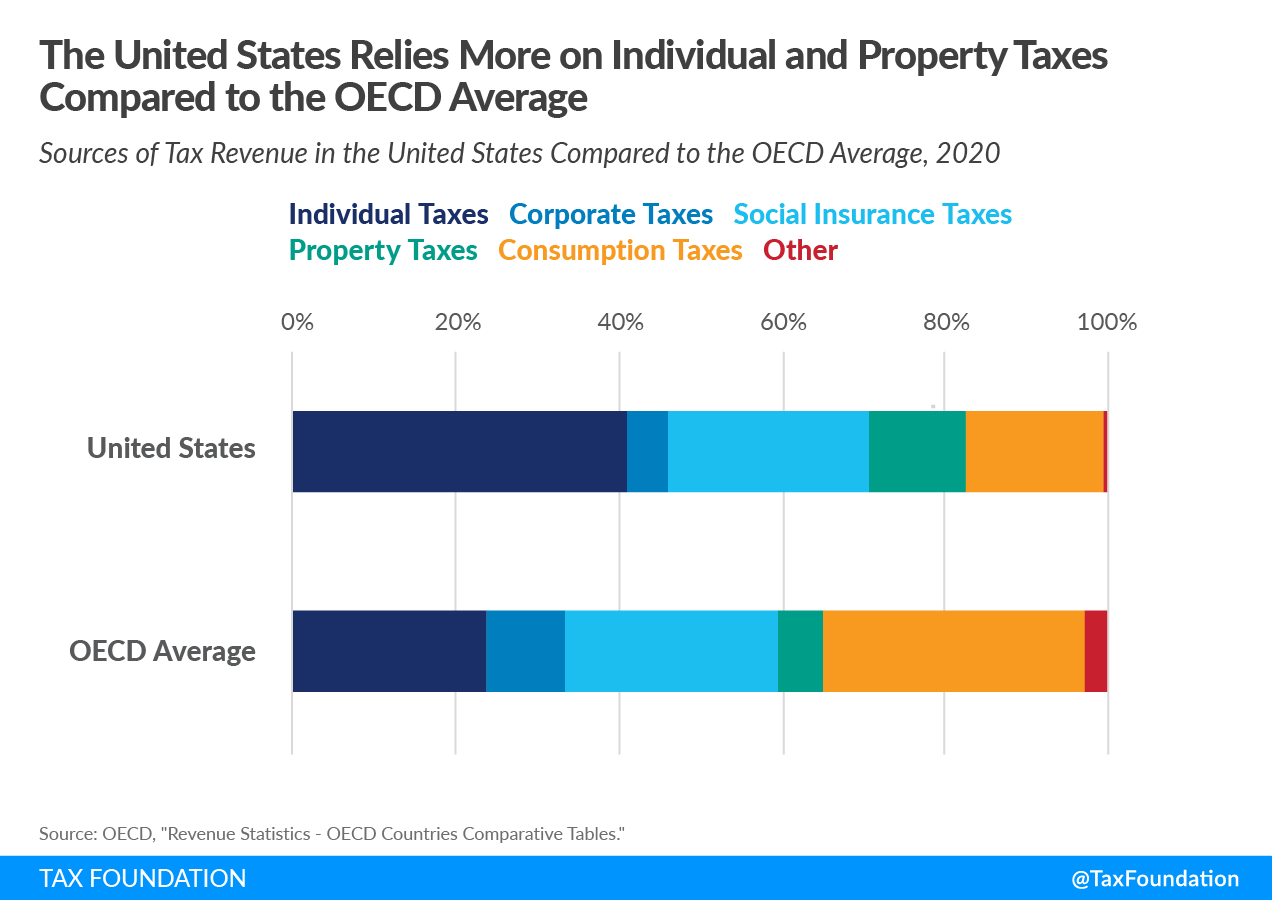

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Property Taxes Property Tax Analysis Tax Foundation

Property Taxes Property Tax Analysis Tax Foundation

Pin By Gene On Castlebee Homeowner Property Tax Info

Property Taxes Property Tax Analysis Tax Foundation

Taxes In France A Complete Guide For Expats Expatica

Income From Property Tax Rates In Pakistan 2021 22 In 2022 Property Family House Separating Rooms